The Crisis We’ve Ignored for Far Too Long

I serve as the Republican Spokesman on the House Personnel & Pensions Committee, and though we didn’t figure out where to come up with $130-some billion necessary to pay off our unfunded pension liability this legislative session, we did make some changes to bring some stability to our police and fire pensions, which is a start.

Illinois’ public pensions are in shambles and are the worst funded in the nation, with nearly 25% of our general revenue now going to pay off the debt. And at the local level, it is probably higher. This is the largest problem facing Illinois today. My aim here is to lay out the reality of our pension problem in a simple and concise way that will convince you that this issue can’t be avoided any longer.

The Big Picture

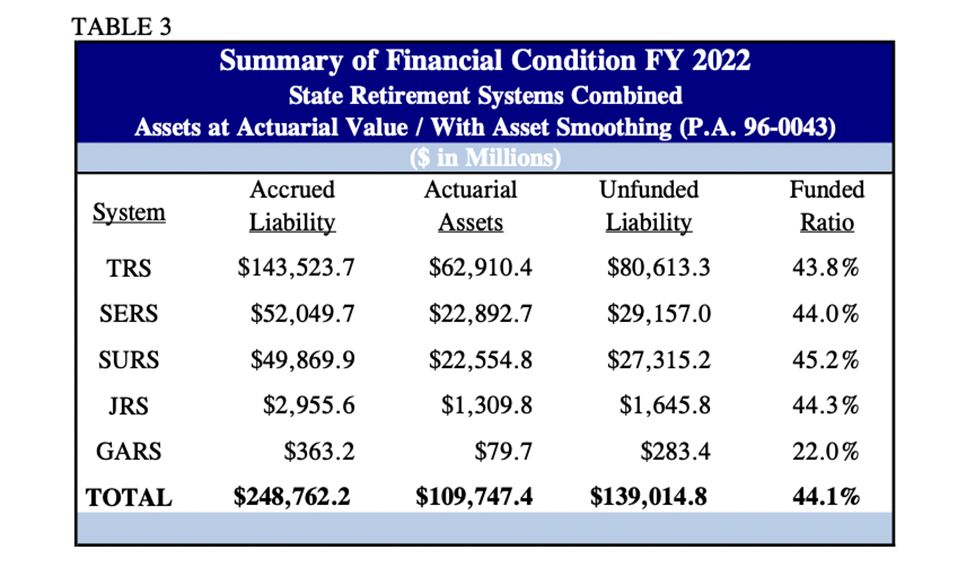

There are 5 pension funds administered by the State of Illinois – these are for state employees, state university employees, teachers outside of Chicago, judges, and lawmakers. The legislative pension fund is the least well-funded at around 22%, but all of the funds are in trouble. The State University Retirement System has the highest funding ratio at only 45.2%. (“Funding Ratio” is defined as the percentage of assets within the fund needed to pay benefits. A fully funded plan will have a funding ratio of 100%.)

Illinois also has a strict constitutional limitation on reducing pension benefits. Article XIII, Section 5 of the Illinois Constitution says explicitly that benefits of membership in a public retirement system ‘shall not be diminished or impaired.’ This places strict rules on changes that can be made to existing pensions. A constitutional change would have to happen before changes could be made to existing pension benefits.

This constitutional limitation is why Tier II, which was an attempt passed in 2010 to make state public pensions more affordable and sustainable, only applied to new hires. And now, as we’ll talk about in a bit, even Tier II needs to be changed.

Additionally, there are hundreds of local pension funds and funds for police and firefighters. These funds are also in trouble and are forcing local governments to raise property taxes, increase local fees, and cut essential services like ambulance services to make their payments. With every local and state tax increase or fee increase, pressure to pay pension payments is likely a driving force. If we want to get Illinois taxes in check, we have to tackle the pension problems.

Tier II Fix

The “Tier II” pension was meant to be a more sustainable pension plan from the standpoint of cost to the state, with more modest benefits, a less generous Cost of Living (COLA) adjustment and a longer time for members to become vested.

- As happens far too often when passing legislation, the General Assembly did not consider the downstream effects of what it was doing when this law was passed. Now it has become clear that Tier II doesn’t meet Federal requirements known as “safe harbor” provisions, which are rules that ensure that employees receive a pension benefit of at least what they’d receive if they were part of the Social Security system. Changes must be made to bring the Tier II benefit structure into compliance with safe harbor, otherwise Tier II retirees will have a cause of action to recover the shortfall, and that shortfall will be paid by local taxpayers, not the state.

- I have introduced a bill with a fix for Tier II. Other legislators have different plans. This will not be a simple fix. Since our Constitution does not allow for benefits to be diminished or impaired, we find ourselves in a situation where we have to determine how best to comply with safe harbor at the lowest cost, and then figure out how it’s going to be paid for. This is one of the most urgent changes that must be made.

Not A Good Look

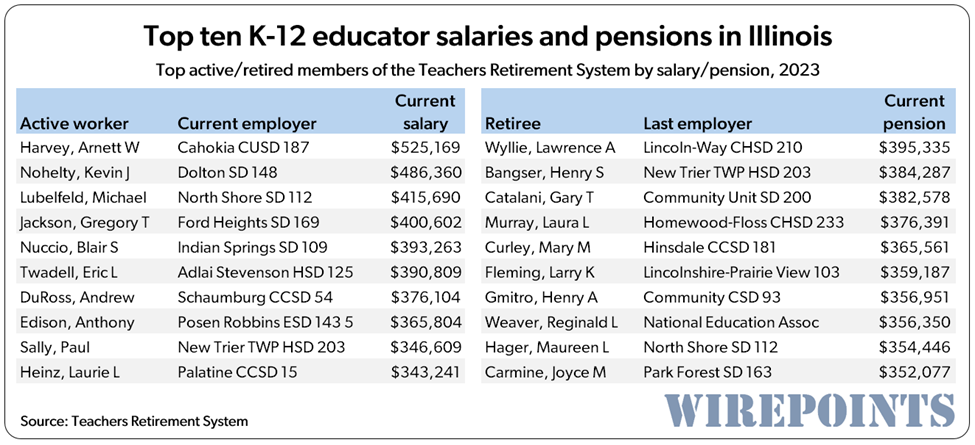

A recent Wirepoints article explained in great detail the results of bad financial decisions that were made setting up these pension systems. There are many pensioners who are receiving more in retirement than they ever made while they were working. The number of active workers and pensioners receiving over $100,000 annually has increased by 50% since 2018. There are over 43,000 pensioners receiving annual pensions of over $100,000. 82 of them are former legislators or statewide officials.

Additionally, there are loopholes in the system where employees can boost their pension with temporary salary increases at the end of their career. In the article an example is:

“Meanwhile, the top Chicago municipal pension belongs to yet another beneficiary of the pension loophole for union leaders: Dennis Gannon. His current annual $232,000 pension was boosted when he was hired by the city for a single day then granted an indefinite leave of absence till his retirement at age 50. In all, Gannon can expect to receive over $5 million during his retirement.”

Pension boosting like this is a blatant affront to taxpayers and should not be allowed.

Additionally administrators at public school districts should not be making over 17x the average household income of their district.

Taxpayers deserve answers about these kinds of salaries that lead to inflated pensions, because they’re the ones footing the bill. There are many hardworking public servants across our state, and some of whom are probably listed in this chart. But, as they say, when you’re in a hole, quit digging. And with no upper limits on salaries, that means the pension hole gets worse.

Local Pensions, Statewide Problem

In 2018 (2018!), I wrote a blog post about the problems local pension funds are facing. Here’s a snippet:

Municipalities across Illinois are now confronted with the choice of cutting essential services or raising taxes to avoid having their pension contributions certified as delinquent, thus risking the loss of millions in LGDF funds:

- In Mattoon, where pension bills are half a million dollars higher than last year, ambulance services are being eliminated.

- Springfield’s City Council acknowledged the growing pension costs could mean the city will have to cut services or raise taxes.

- Normal will raise property taxes to fund pension increases

- Danville has instituted a “public safety pension fee,” which will cost residents up to $267 annually.

- East St. Louis, which depends almost exclusively on the LGDF for its entire budget, could see it totally confiscated to pay pension obligations. (As you read this, East St. Louis is once again facing the loss of its current LGDF because it can’t meet its obligation to the municipal police pension fund)

And, as I predicted then, there was no “adult conversation about what’s about to be dumped upon thousands of unsuspecting citizens of Illinois.”

Local governments are not going to be able to fix this issue by themselves. Property taxes will keep increasing or vital services will be cut until this is fixed. It is going to take a statewide solution and serious policy makers on both sides of the aisle to make it happen.